Jim Cramer, CNBC 'Evolve' In Coverage of Index Funds

by Murray Coleman - Monday, 11 April, 2022

The evidence against active management keeps mounting. As we've reported in the past, S&P's longtime SPIVA research series has consistently found that a vast majority of index funds outperform over time those run by active managers. Separately, ongoing studies by independent researchers at Dalbar show that the average investor — who tends to capitulate to emotions and sell at the worst times — has significantly underperformed the S&P 500 index over the longer haul.

Throw in a growing body of academic research with roots going back 50 years or more from Nobel laureates like Eugene Fama and Harry Markowitz and it's not surprising to see passive investing's media spotlight ticking up a bit in recent years. In fact, the rise in popularity of index funds spurred a best-selling book last year by veteran Financial Times correspondent Robin Wigglesworth.1

In "Trillions: How a Band of Wall Street Renegades Invented the Index Fund and Changed Finance Forever," he observed: "Passive investing now likely accounts for over $26 trillion (globally), more than the entire gross domestic product of the United States, and is a force reshaping markets, finance, and even capitalism itself." (To watch the first of IFA President Mark Hebner's series of video interviews with Wigglesworth, click here.)

Besides mainstream books and coverage by major media outlets such as the Wall Street Journal, the Financial Times and Barron's magazine, index-themed investment stories have increasingly made it into cable news coverage. Throughout the day, these channels pump television's airwaves with reports based on hourly swings in stock prices, prognostications by active managers and corporate press releases.

The growing education and appreciation of passive investing, however, hasn't escaped at least one such purveyor of news focused on short-term market gyrations. CNBC, the pioneer in this field, over the years has stepped up its spot reporting of indexing's gains — both in terms of fund asset growth and performance. In fact, by 2019 we started seeing reports like the video below, which put a spotlight on the results of SPIVA's ongoing research series.

It's a message that in recent years has become less of an anomaly by the broadcaster. Bob Pisani, the network's senior markets correspondent, continues to file reports with similar messages chronicling index funds' longer-term outperformance. So does his colleagues at CNBC. Indeed, the network these days regularly covers SPIVA research results — including S&P's more recent findings, which showed the same pattern of lagging returns by active management across different fund types and asset classes.2

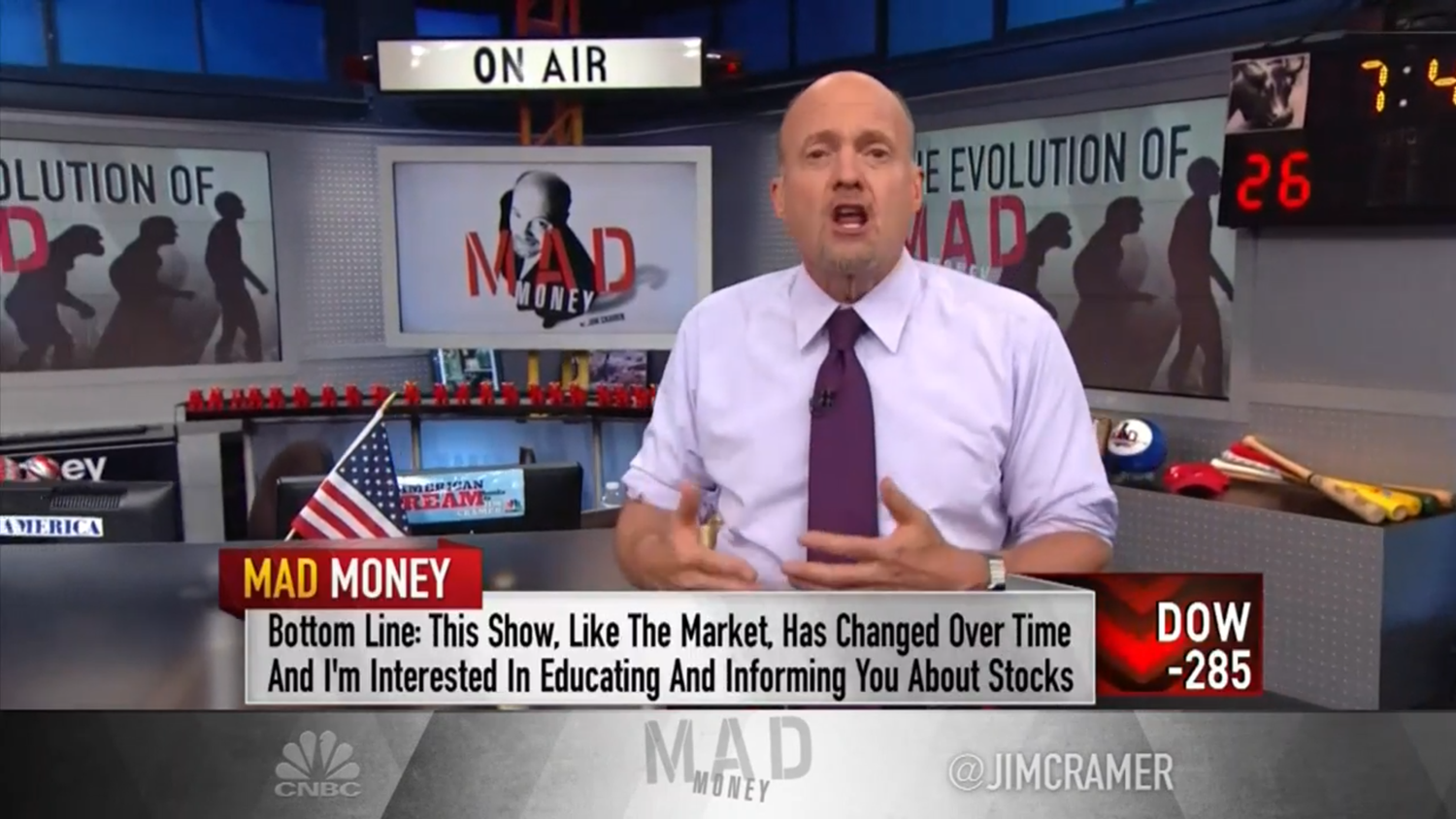

Of course, the star of CNBC is Jim Cramer. He rose to cable television fame as one of America's biggest cheerleaders for actively trading in global stock markets. Lessons learned from such moves, he told millions of viewers on his CNBC "Mad Money" show, led him to build a career as a broker and hedge fund manager.

But after more than a decade on the air, Cramer took to the airwaves in 2019 to explain that his thinking about investing has "evolved" over time. So, apparently, has his broadcasting message. "I'm cognizant that the market is hard — you've got time burdens, you've got demands," he related during the show, which originally aired on Sept. 3, 2019.

At the same time, he acknowledged that investors can easily become "bewildered" trying to pick individual stocks.

"That's why I've emphasized that I'm not just okay with index funds, but I insist you use them," Cramer said.

What's behind such a seemingly dramatic change? To critics, it's no coincidence that passive investing has finally broken into the mainstream and taken much of the thunder (i.e., assets) from actively managed mutual funds.

Studies tracking Cramer's Action Alerts PLUS portfolio, which he manages for others and incorporates many of his "Mad Money" picks, have also raised questions about his stock prognosticating prowess when compared over time to broad market benchmarks. (See "Jim Cramer vs. S&P 500: Chasing Mad Money.")

The Great Recession has changed how investors look at stocks, Cramer asserted. "It changed me, it changed the show," he said. As a result, his "Mad Money" manifesto has undergone a sort of metamorphism. "I would not own a single stock until I'd put away at least $10,000 into an index fund, either through your IRA or your 401(k)," he added.

Cramer went on to emphasize that his role has expanded "to educate, to entertain, to teach" investors because "it just isn't enough to just give you stock ideas."

Instead, Cramer wants investors to "understand the stock market enough for you to make a judgement whether you can do it yourself." This means he wants to largely "leave behind" new and "hot" stock ideas in favor of presenting broader investment "themes" to viewers.

Cramer admitted in the past he didn't try to discourage anyone from "refraining" to pick their own individual stocks. "Let me do so tonight — I would actually vastly prefer you to invest in index funds than stay in (active) mutual funds," he said. "Mutual funds have not distinguished themselves enough to take the percentages (of investment assets) that they do."

At times, some circumstances are likely to arise in which managers might seem to "acquit" themselves from the industry's uninspiring track record, he added. But Cramer was quick to point out that turnover in active management is an issue, and in any case, past performance is no guarantee of future success.

"I am not a shill or a snake oil salesman for individual stocks," he said. "I am a believer in the asset class of stocks as part of an overall way to save money for retirement, tuitions, vacations — anything your heart desires."

Cramer urged investors of all stripes to expose their portfolios to stock markets. He also recommended that his viewers check out Warren Buffett's so-called Golden Anniversary report. The letter to investors dates back to 2015 and marked Buffett's 50th year at the helm of global conglomerate Berkshire Hathaway. In it, the fabled 'Oracle of Omaha' made a powerful argument for stock investing using index funds.3

The letter is an "amazing read," according to Cramer. It answers a fundamental question of stock investing, he observed: "Why do they (stocks) work? Because they represent the sum progress of business and the prospects for business going forward. They represent the wealth that companies create in aggregate, and the sharing of that wealth with shareholders."

Cramer would like to see more people go "along for that ride," but in what he terms a "responsible" way. And that means, in his view, "most definitely owning an index fund." While partial to owning a fund tracking the S&P 500 index, he stressed that some sort of portfolio diversification should be an important end-goal.

"Once again for those who don't get it, here's my bottom line," he summarized. "This show has changed over time from one where we pick stocks for you to one where we educate you about stocks so you can understand why an index fund of stocks might be worth investing in."

Footnotes:

- Robin Wigglesworth, "Trillions: How a Band of Wall Street Renegades Invented the Index Fund and Cahnged Finance Forever," Penguin Random House, 2021.

- CNBC, "New Report Finds 80% of Active Fund Managers are Falling Behind the Major Indexes," March 27, 2022.

- Warren Buffett's 50th anniversary letter to Berkshire Hathaway shareholders, Feb. 28, 2015.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Take the IFA Risk Capacity Survey (www.ifa.com/survey) to determine which portfolio captures the right mix of stock and bond funds best suited to you. For more information about Index Fund Advisors, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.